Tax Rates

Need to contact us about enquiries issues or anythig else. This page links to all the information that is needed in order to reach us.Corporate Tax

A Thai Company generally pays tax at 30% of Net profit. However, some types of company are entitled to a rate reduction.

• Small business with paid up capital less than 5 million baht

20% of Net profit < 1 million baht

25% of Net profit 1-3 million baht

• Company registered in the Stock Exchange of Thailand (SET)

25% of Net profit < 300 million baht

• Newly registered company in the stock exchange of Thailand (SET) and Market for alternative Investment (MAI)

25%of Net profit for newly registered company in SET

20% of Net profit for newly registered company in MAI

• Bangkok International Banking Facility and Regional Operating Headquarters

10% of Net profit from qualified income

• Association and foundation

2% or 10% on gross receipts

Withholding Tax

|

Types of income |

Withholding tax rate |

|

1. Employment income |

5 - 37 % |

|

2. Rents and prizes |

5 % |

|

3. Ship rental charges |

1 % |

|

4. Service and professional fees |

3 % |

|

5. Public entertainer remuneration |

|

|

6. Advertising fees |

2 % |

Personal Income Tax

Tax is applied on a graduated scale as follows:

|

Net Annual Income (Baht) |

Tax Rate |

|

|

0 |

150,000 |

0% |

|

150,001 |

500,000 |

10% |

|

500,001 |

1,000,000 |

20% |

|

1,000,001 |

4,000,000 |

30% |

|

4,000,001 |

over |

37% |

Other types of taxable income and the rate of standard deduction include:

. Interest, dividends, capital gains on the sale of securities: Forty percent but not exceeding 60,000 baht.

. Rental income: Ten percent to 30 percent depending on type of property leased.

. Professional fees: Sixty percent for income from medical practice, 30 percent for others.

. Income derived by contractors: Seventy per cent.

. Income from other business activities: Sixty-five percent to 85 percent depending on the nature of the business activity.

The following annual personal allowances are permitted:

|

Taxpayer |

THB 30,000 |

|

Taxpayer's spouse |

THB 30,000 |

|

Each child's education |

THB 15,000 (limit 3) |

|

For taxpayer contributions to an approved provident fund |

THB 10,000 |

|

For taxpayer and spouse for interest payments on loans for purchasing, hire-purchasing or construction of residential buildings |

THB 10,000 |

|

For taxpayer and spouse with respect to contributions to Social Securities Fund |

Actual contribution not more than 10% of adjusted income |

Thailand Property Taxes (Condo, Villa, or House)

The following is an overview of property taxes in Thailand and how they are calculated. Please consult one of our property lawyers with regards to your property taxes in Thailand.

|

Tax Type |

Tax Rate |

|

Transfer fee |

2% of the registered value of the property |

|

Stamp Duty |

0.5% of registered value. Only payable if exempt from business tax |

|

Withholding Tax |

1% of the appraised value or registered sale value of the property (whichever is higher and if the seller is a company). If the seller is an individual, withholding tax is calculated at a progressive rate based on the appraisal value of the property. |

|

Business Tax |

3.3% of the appraised value or registered sale value of the property (whichever is higher). This applies to both individuals and companies. |

| TAX | WHICH PARTY NORMALLY PAYS |

AMOUNT |

| Transfer fee | Buyer | 2% of the registered value |

| Stamp Duty | Seller | 0.5% of registered value |

| Withholding Tax | Seller | 1% of appraised value or registered sale value (whichever is higher) |

| Business Tax | Seller | 3.3% of appraised value or registered sale value (whichever is higher) |

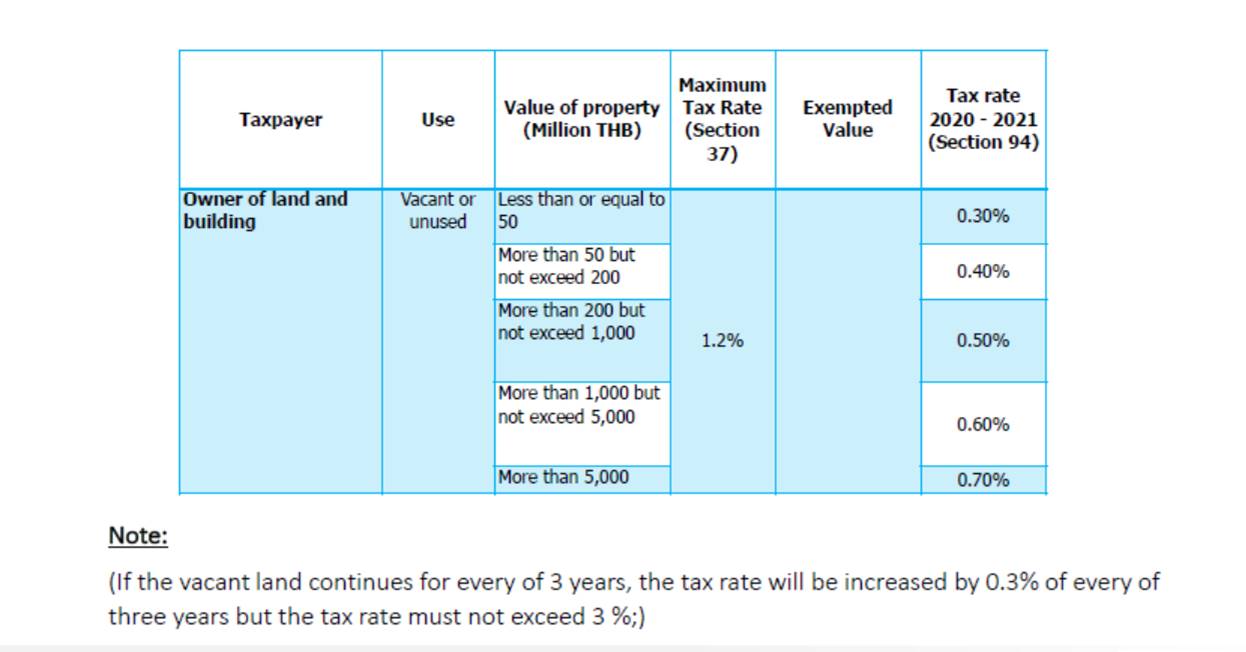

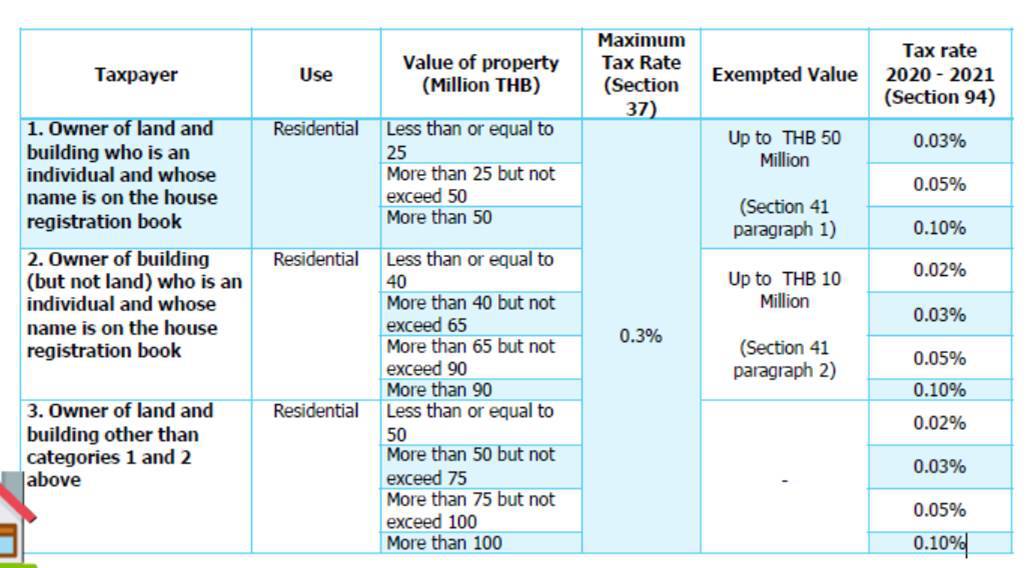

LAND AND BUILDING TAX LAW

Property tax is levied from 1 January 2020.

Tax calculation

Assessed value of land or building -Exempted value of tax base* = Value of tax base

Value of tax base x Tax rate = Land and building tax 9

- Exempted value of tax base (1) In case of an individual’s land or building used for agriculture: The owner of such land or building is entitled to tax exemption worth up to 50 Million baht. (2) In case of an individual’s land and building used for residence where such individual’ name is in the house registration on 1 January of such tax year: The owner of such land or building is entitled to tax exemption worth up to 50 Million baht. (3) In case of an individual’s building used for residence where such individual’ name is in the house registration on 1 January of such tax year: The owner of such building is entitled to tax exemption worth up to 10 Million baht.